Graham rounds-up the latest TAG updates. What’s changing, and what does it mean in practice?

Earlier this month (April 2025), the UK Department for Transport (DfT) published the latest round of forthcoming changes to its Transport Analysis Guidance (TAG). These are due to go live in May, alongside others previously published in November 2024 and in one case October 2024 (other October 2024 items have already gone live).

In total there are six forthcoming change notices, covering a wide range of topics. The Oct/Nov 2024 ones were accompanied by publication of (most of) the actual updated TAG units, databook and other items. This was not the case for the latest ones, but the material is promised by the end of May*. Note, though, that some of the earlier updates have been overtaken by the latest ones.

* Update: these have now been published

As usual, I’ve updated my Tag-at-a-Glance page to give a unit-by-unit (or workbook-by-workbook) summary of the changes.

At first glance, it looks like a bumper set of changes. Certainly there is a lot to digest. But much of it is either routine updates to data tables, or updated general guidance. There are only a few substantive changes to specific requirements or processes.

The main areas of change are:

- A new base year

- Updated appraisal parameters

- New guidance on the ‘new modes’ problem

- Updated guidance on dependent development

- Updated guidance on supplementary economic modelling

A new base year

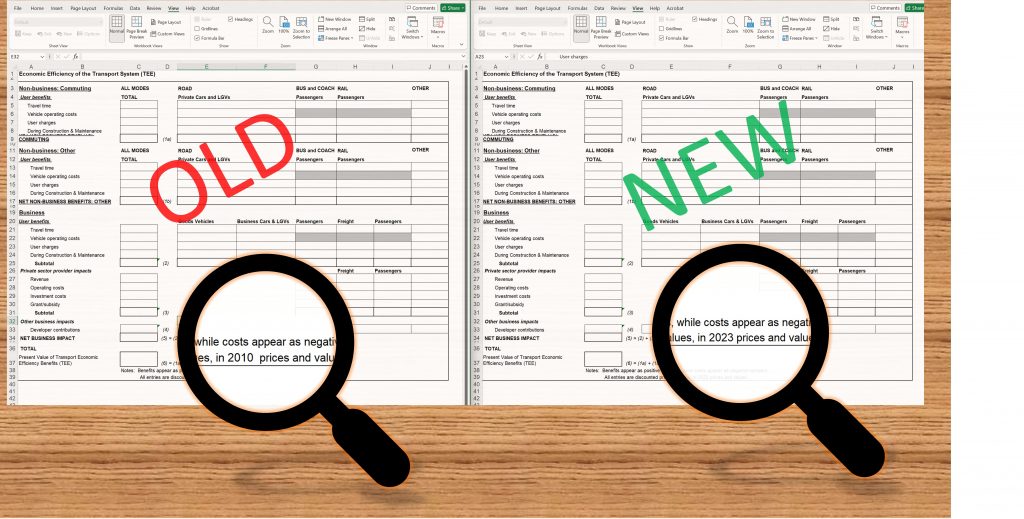

The most eye-catching change – but perhaps the least significant in practice – is the change of base year from 2010 to 2023.

This is the base year for ‘prices and values’ in appraisal – nothing to do with a model’s base year. It’s about two technical but very important adjustments that nearly always get done in an appraisal, so as to be fair both within a single project and when comparing results across projects:

- Stripping out the effect of inflation in the general economy (known as ‘deflating’ the prices) – this is to avoid distorting the value of costs and benefits in different years

- Reflecting the fact that benefits which happen sooner are more valuable than those which happen later – and vice versa for costs (‘discounting’ the values)

Both processes currently convert the costs and benefit figures to their 2010 equivalents. The results are then in “2010 prices and values”. This will in future be 2023 prices and values.

The base year doesn’t actually make a difference to benefit-cost ratios (BCRs) or whether a proposal is good value for money. You always do the same thing for both costs and benefits, so it’s an apples to apples comparison, and in a BCR the changes cancel each other out. It does affect the net present value (NPV) figures, but as long as all proposals use the same base year then you can still make fair comparisons between them.

The real difference is presentational and psychological. As the base year recedes into the past, the cost and benefit figures diverge from the ‘real world’ numbers that they started from. For example: a construction cost of £100m in 2025, when appraised today, becomes less than half of that in 2010 prices and values[i]. This can be confusing at first glance, and in any case it underplays the scale of the numbers.

When I get the chance, I’ll do a separate post with more detail on these processes and how the change in base year works. But for now, the message is that it’s just a presentational change to the maths, with no substantive impact.

Even so, a lot of TAG is affected. The Databook will switch over to the 2023 base (you can try it out here). As before, it allows you to select a different base year for the occasional work that needs one. There will be corresponding updates to the Common Analytical Scenarios (CAS) databook; the worksheets for air quality valuation, greenhouse gases, landscape monetisation, noise and aviation noise; and the Active Mode Appraisal Toolkit (AMAT). Before you dive into these, however, note the further Databook changes coming up below. Finally, some TAG units have minor wording changes to reflect the new base year.

The important things for practitioners will be to decide whether and when existing projects should switch over to the new base year – and to make sure not to accidentally mix 2010-based and 2023-based figures.

Updated appraisal parameters

As is often the case in the routine TAG updates, various sets of parameters are being updated. This time around, though, the logistics are a bit more complex, as these updates have come in two separate forthcoming change notices.

- The first, announced in November 2024, involved changes to road and rail vehicle operating costs and marginal external costs (MECs). The updated Databook (v2.0) and corresponding versions of the appraisal worksheets and the AMAT were published alongside the notice, and also included the change to the base year.

- The second, in April this year, had a further set of updates covering economic and demographic parameters, non-exhaust emission factors and carbon values, plus other changes. By the end of May, DfT will publish a new Databook (v2.01), worksheets and AMAT that that include both sets of changes.

So although the v2.0 materials are still available for now, they won’t actually go live as they will be replaced by the v2.01 versions. Updated TUBA, COBALT and WITA, reflecting all the changes, will also be available.

Having cleared that up, I’ll run quickly through the combined set of changes.

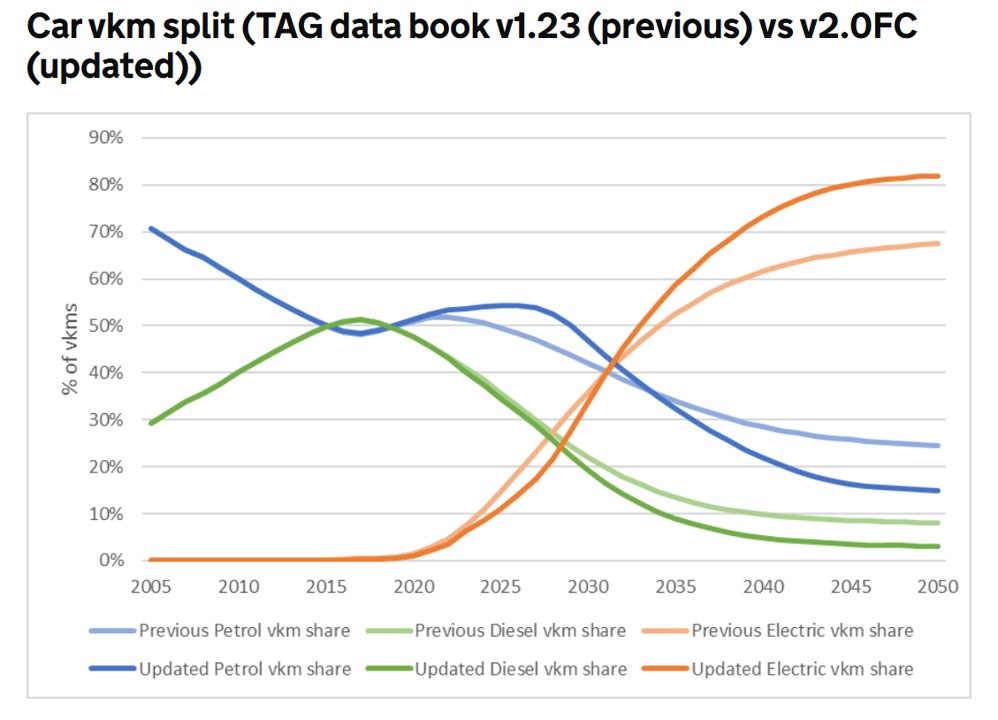

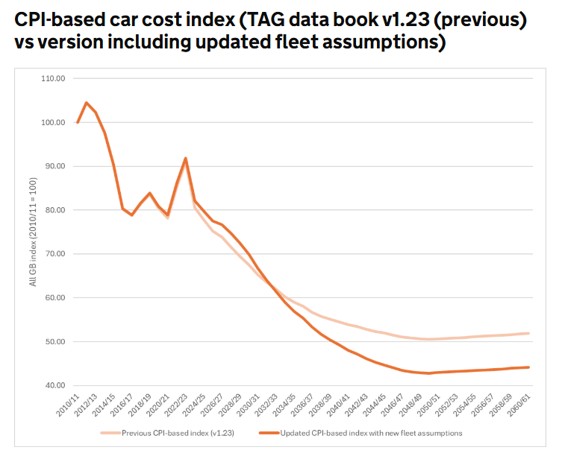

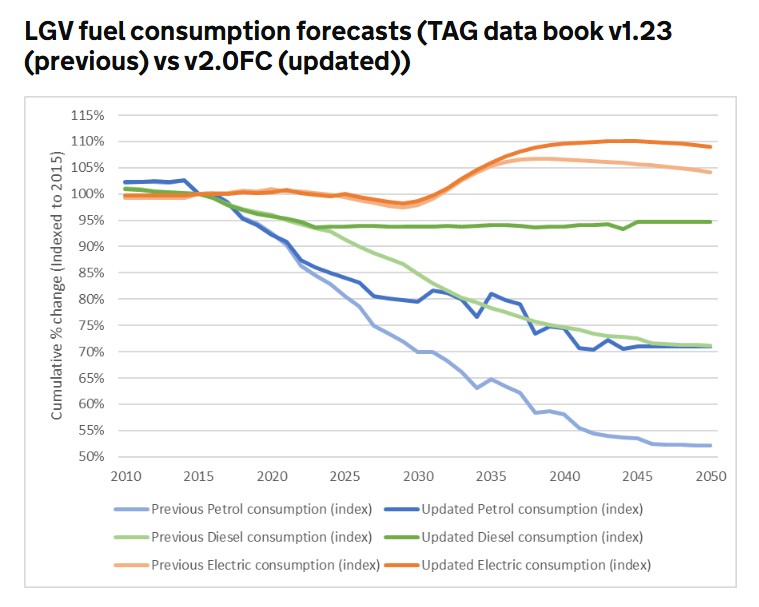

- There are updated road vehicle fleet mix and efficiency assumptions (tables A1.3.8 to A1.3.10), reflecting the 2024 zero emission vehicle mandate and other factors. These also feed into rail demand forecasting (table M4.2.2). The FC notice has some handy ‘old v new’ charts illustrating the changes, and I’ve picked out a couple of interesting ones below.

- There is a new two-stage process for valuing changes in fuel and energy costs, in order to reflect DESNZ guidance on using the long-run variable cost of energy supply. It feeds into the calculation of user benefits for appraisal, but not the calculation of perceived fuel costs for modelling. If this affects you, I can do no better than point you to DfT’s own explanation. Databook Table A1.3.7 gets new columns for the non-variable elements of these costs, and TUBA will be updated to reflect this change.

- The Marginal Economic Cost (MEC) parameters have been updated in line with a range of factors that feed into them. This affects Databook Table A5.4.2 and the AMAT. The differences are minor.

- The economic and demographic outturn and short-range forecast data (up to around 2029 or 2030) are updated with the latest figures.

- There are updated long-term high and low population growth scenarios, using ONS 2022-based projections. (These are only used when extrapolating demand beyond the final modelled year, which we don’t often do.)

- There are updated non-exhaust particulate emissions factors for road vehicles (Databook table A3.5d and A3.5e).

- Databook Table A1.3.1 (values of time per person) will be corrected to uprate values by the annual 1.5% growth rate now used for appraisal, not the GDP per capita growth rate as still used for modelling.

- Traded carbon prices will be updated in line with the December 2024 DESNZ update. (This is the price of trading scheme allowances, not the ‘carbon value’ of emissions.)

- Also on carbon, there will bs a new table (A5.2.1) of assumptions for future carbon prices in the aviation sector under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

Left: Car vehicle-km split. Electric cars are forecast to ramp up more slowly than before, but then exceed previous take-up, so that by 2045 80% of cars will be electric (previous forecast was below 70%).

Centre: CPI-based car cost index. This is a car-travel cost index used in rail demand forecasting. The cost is expected to fall over the next 25 years or so; after 2032 the fall is greater than in the previous forecast.

Right: LGV fuel consumption forecasts: A big reduction in the forecast improvement of petrol/diesel LGV fuel efficency.

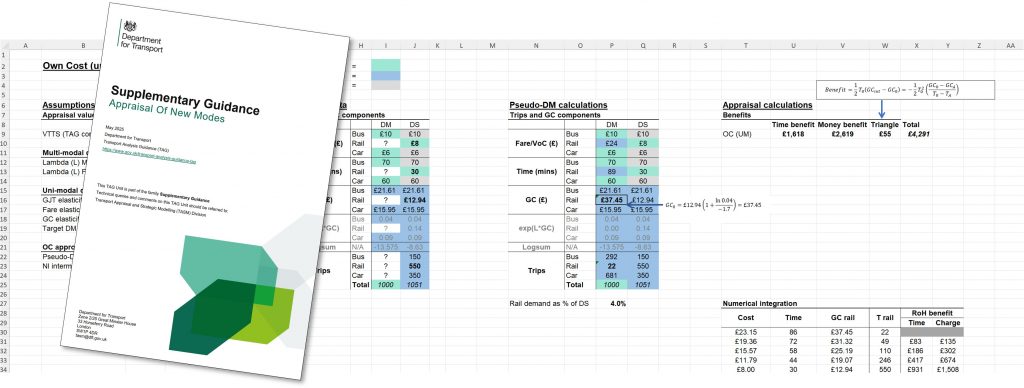

New guidance on the ‘new modes’ problem

The next area of change is a new supplementary guidance document on appraising new modes. Specifically, it offers a new option for dealing with the TUBA ‘new modes problem’. This was actually announced (and the draft guidance was published) in the October 2024 set of forthcoming changes, but not going live until May 2025. I posted on this at the time, so won’t repeat the details here. The only new thing to mention is that the existing TUBA guidance on large cost changes in appraisal, which is related to this, will be moved into TAG Unit 1.3.

Updated guidance on dependent development

Another change is a set of updates to the guidance on dependent development (DD) in Unit A2.2.

As a reminder, DD is part of wider economic impacts (WEI), and refers to situations where a transport scheme unlocks development that couldn’t happen without it – for example, a large housing site that needs the extra transport capacity that a new road or public transport scheme would provide. TAG allows you to claim the land value uplift as a scheme benefit, although you have to net-off the incremental congestion disbenefits caused by the development traffic. The DD benefits can often boost an economic case.

DfT says the updates are to address two issues: defining DD more clearly, and a tendency for appraisals to overestimate the scale of DD benefits. To fix these issues, the updates have three elements:

- Expanded guidance on defining DD

- Extra guidance on how to deal with uncertainty around the benefits

- A new sensitivity test (actually a switching-value analysis) that will need to be applied to the results, to help set out the level of risk if the assumptions turn out to be over-optimistic

There’s a lot to unpack in just this one area, so I’ve done a separate post with more detail. Essentially, though, there is no substantive change to the appraisal method or ‘what the BCRs will be’. It’s really about reinforcing existing guidance and good practice, making sure that only genuinely dependent development is taken into account, and taking a realistic look at the risk if development is slower to materialise than the appraisal assumes.

Updated guidance on supplementary economic modelling

The last of the forthcoming changes is a major re-write of unit M5.3 which covers supplementary economic modelling (SEM).

To recap, SEM is the far reaches of WEI analysis. Most projects, if they cover WEIs at all, only need the more routine TAG techniques such as estimating dependent-development benefits or using WITA to estimate agglomeration benefits. But sometimes you may want to go beyond those techniques: for example, if your project will affect land-use patterns on a regional or national scale and you want to explicitly model this, or if you are particularly interested in a project’s impacts on local employment and Gross Value Added (the latter is essentially ‘local GDP’).

SEM covers a range of ways of doing this, such as land-use/transport interaction (LUTI) models, which do what they say on the tin, and Spatial-Computable General Equilibrium (SCGE) models which are thoroughly hardcore economics.

Generally only WEI practitioners will want to look at the detail of the updates here. Although the updated unit hasn’t yet been published, the forthcoming change notice gives extensive details of what’s changed. The focus will be on reflecting the latest developments in SEM methods, incorporating recent research, and generally improving the guidance. Of course, most schemes don’t get into SEM and can ignore this update altogether.

Finally, there will be consequential changes to the other WEI units (A2.1 to A2.4) and the VfM Framework to update their cross-references to the SEM guidance, along with some other minor edits. All of these previously had substantive updates in November 2024.

And that’s what’s new in TAG for May 2025.

[i] Other adjustments are also made, so this is not the final answer.

Contains public sector information licensed under the Open Government Licence v3.0.

Updated 5 May 2025 with link to post on dependent development. Updated 2 June 2025 to note that all the updated units have now been published.